In a sign that the recent declines in confidence may be reaching a plateau, the survey’s overall outlook score remained consistent with the previous quarter. The Q4 Confidence Score now sits at -4.1 compared to -4 in the previous quarter.

The survey uses business owners’ responses on business performance, confidence and investment intentions to produce an overall Confidence Score between -10 (very unconfident) and +20 (highly confident).

(fall of -0.1 since Q3)

Most represented sectors:

23

Average number

of employees

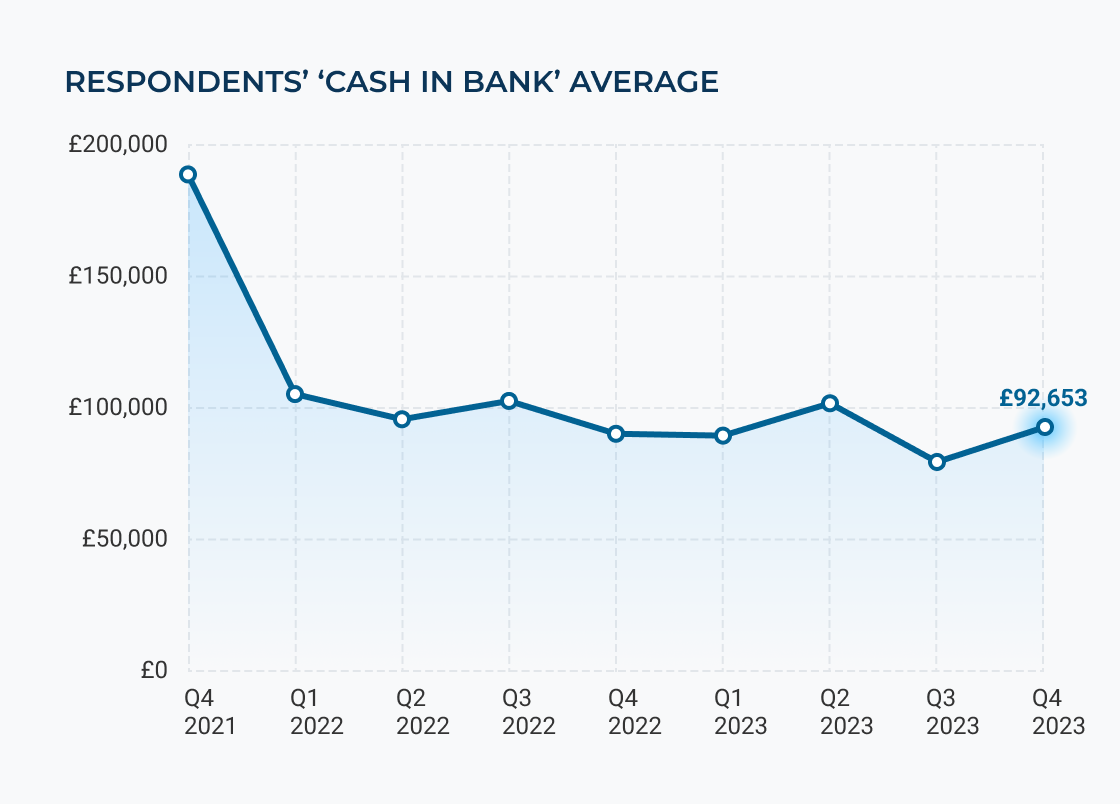

Average cash in bank position:

£92,653

250 survey responses from a range of small business across the UK

Average turnover of respondents:

£2,468,018

Nearly 60% of businesses have been trading for over

15 years

The survey found that the average cash in bank position has increased across the fourth quarter.

On average, SMEs are reporting a cash balance of £92,653, an increase of £13k on the previous quarter.

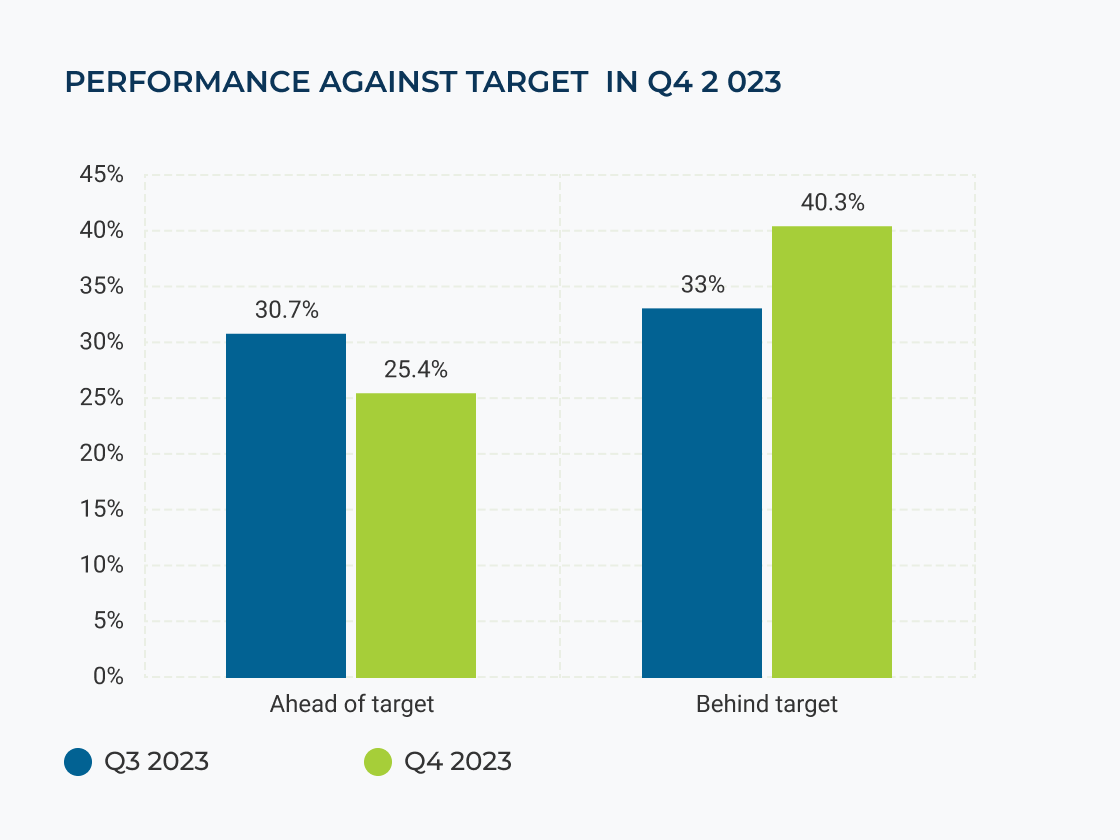

A significant contributor to the overall low level of confidence, the number of SMEs reporting that they were behind target for the quarter increased by 7pp. Correspondingly, the number of SMEs reporting that they were currently tracking ahead of their targets fell to 25%, compared to 31% in Q3.

Correspondingly, the number of SMEs reporting that they were currently tracking ahead of their targets fell to 25%, compared to 31% in Q3.

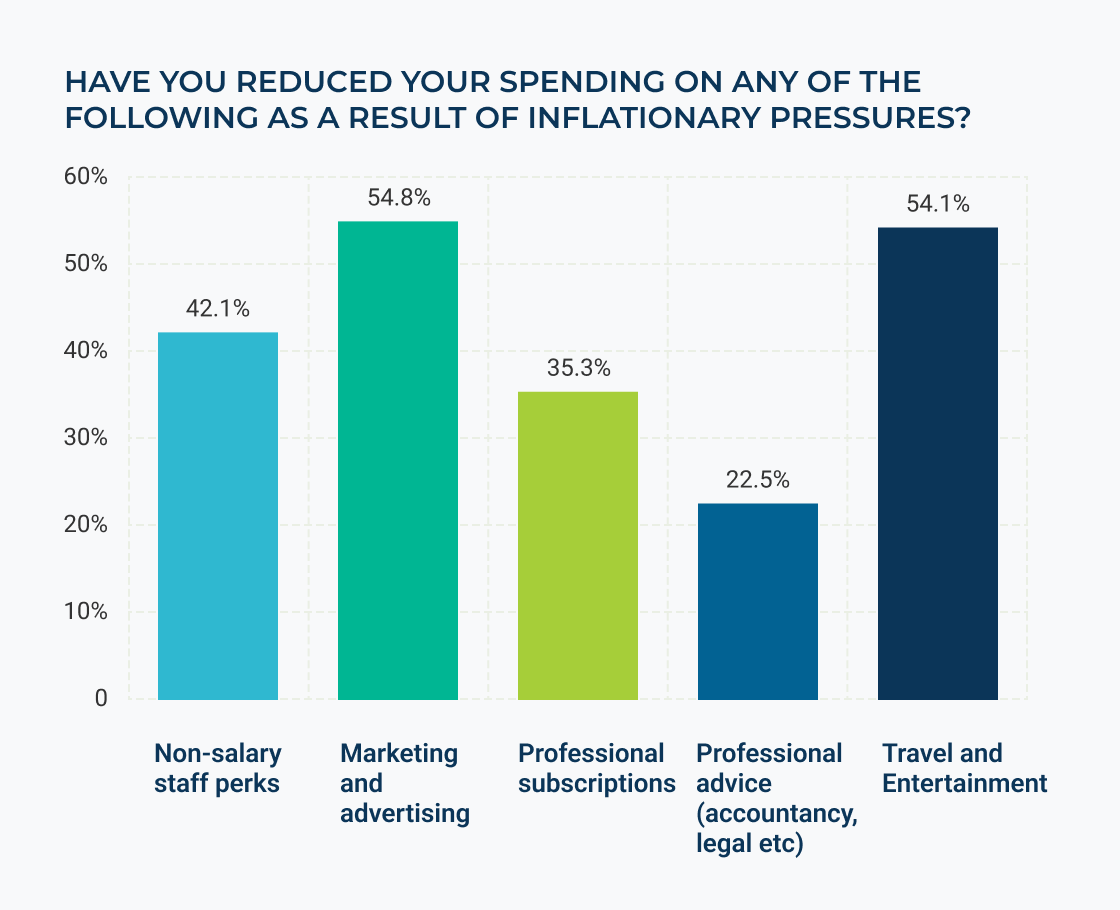

Cost control is an integral part of keeping performance on track when revenues drop. In response to mounting inflationary pressure, over half of firms (55%) have reduced spend on travel and entertainment, whilst 44% have reduced marketing and advertising outlays.

The survey found some evidence to suggest that SMEs are developing a growing resilience to the turbulence of the last few years. The average number of issues keeping smaller business owners awake at night has fallen to 2.71 – a reduction of 0.88 on Q3’s finding

Some of the major shifts in SME worries in Q4 2023 were:

Cash flow

Taxes and other business expenses

Staffing / resource issues

Managing red tape

Finding new customers

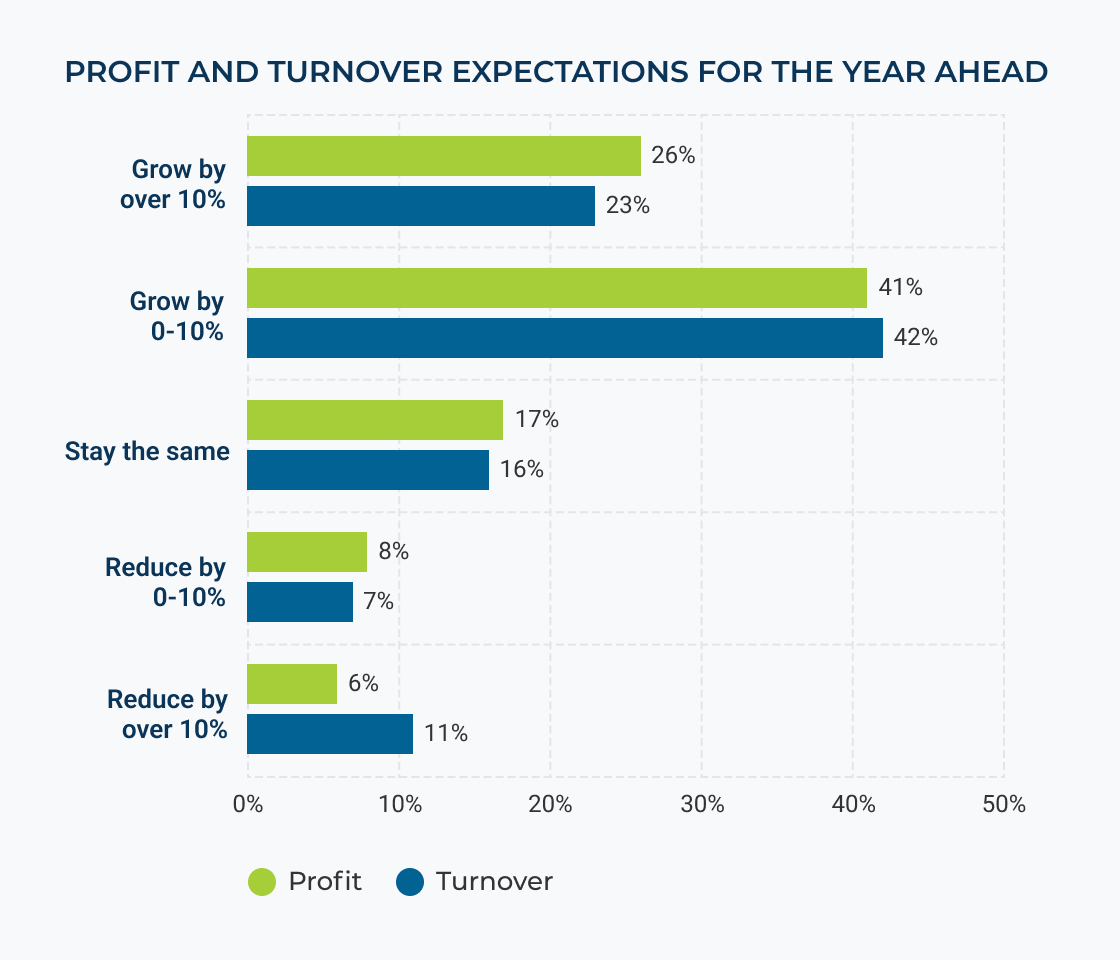

Despite the prevailing operating challenges denting the confidence of UK SMEs, the outlook for the year ahead is more bullish.

Perhaps buoyed by positive indications that the worst of the most recent economic challenges may be behind us, 65% of SMEs are expecting turnover to grow in 2024 whilst 67% expect to grow profits in the same period.

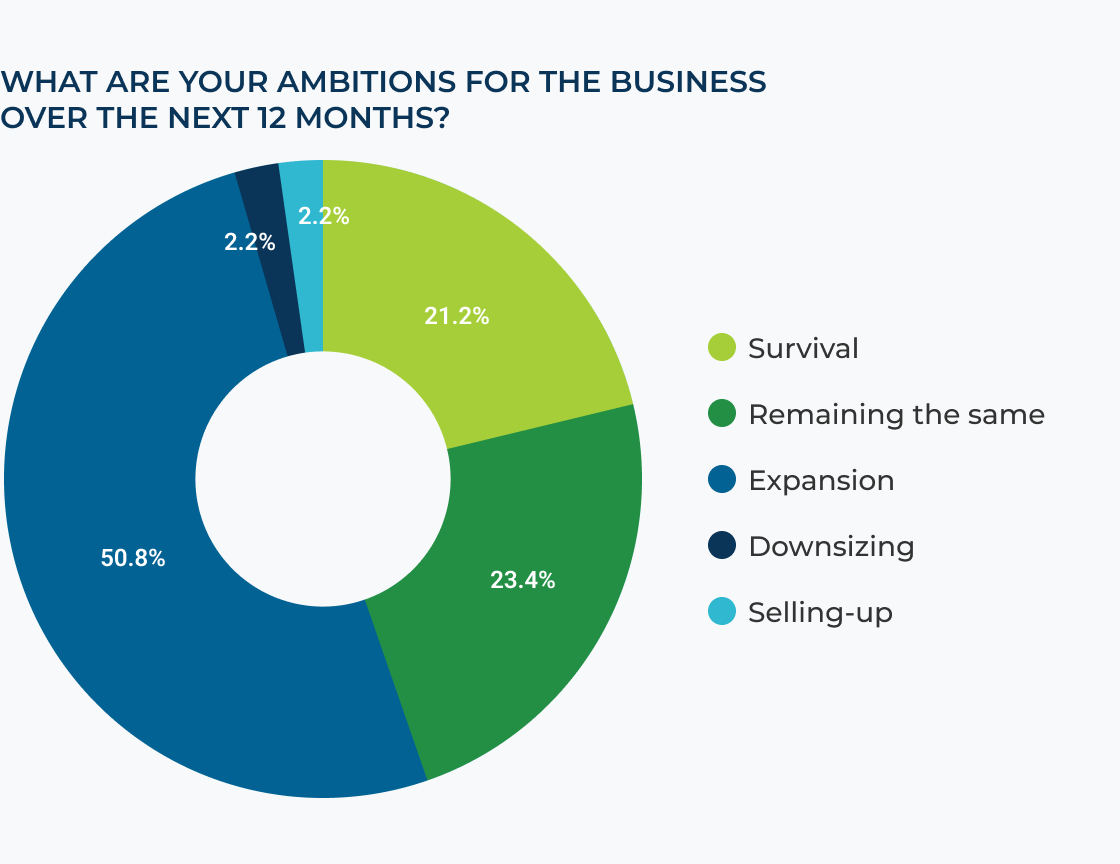

In terms of overall ambition, roughly half of SMEs are planning to expand their operations in 2024 – a finding consistent with the previous quarter. Whilst just over 1 in 5 are simply aiming to survive the year ahead.

Of those who aren’t expecting expansion, 31% cite cashflow and working capital as a barrier to growth (a 9pp increase on Q3).

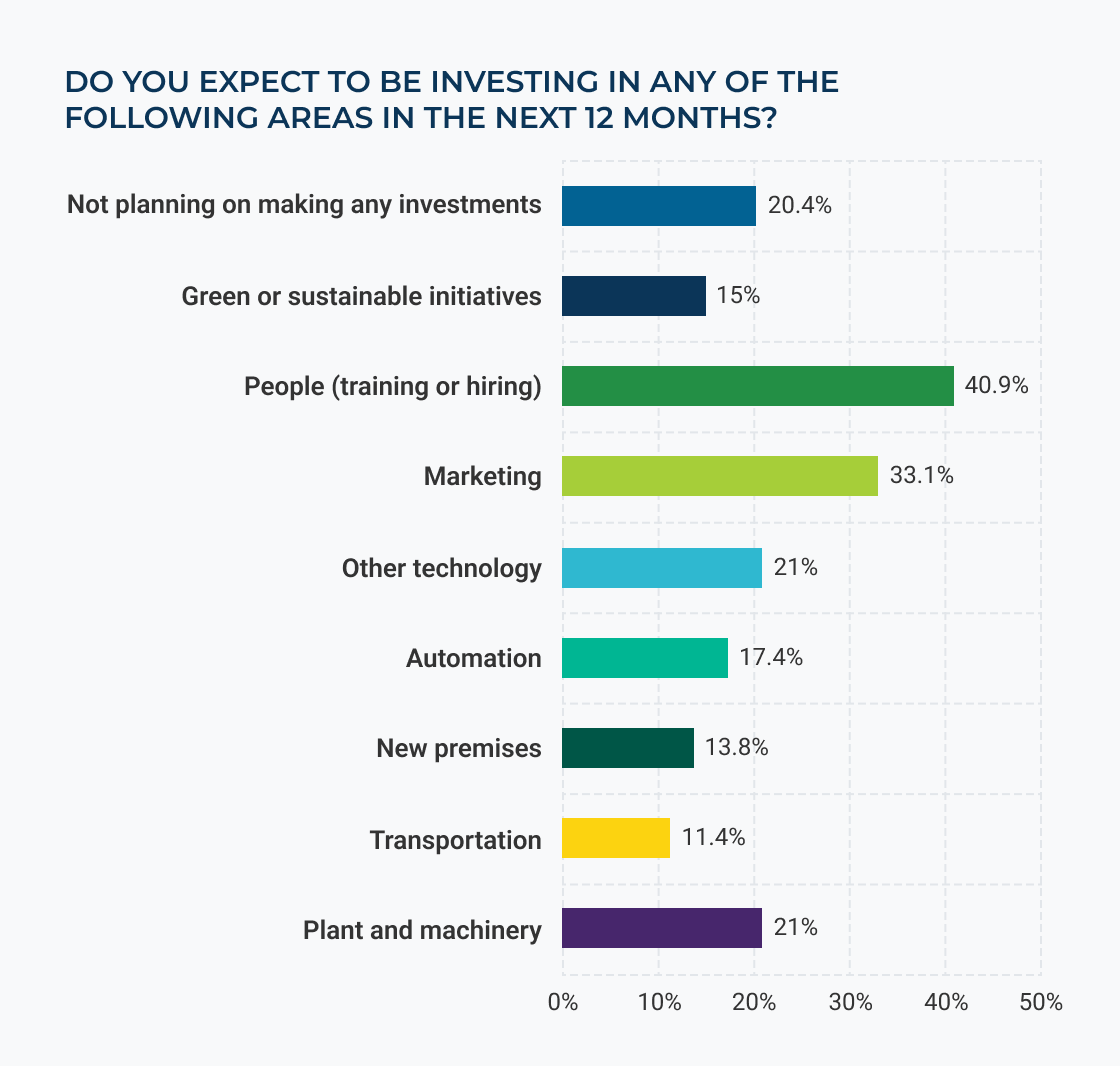

Overall, the number of areas in which respondents were looking to invest has decreased quarter-on-quarter. Our survey found that SMEs were looking to invest in 1.82 areas across their business (compared to 2.55 in Q3 2023). The survey also reports that, on average, SMEs will only commit £21,169 to areas of investment this year, a significant downgrade on the estimated spend of £44k in Q3.

Perhaps in recognition of continuing issues with the labour market, investing in people (training and hiring) was the most frequently cited area of planned investment.

SME access to finance continues to be problematic, with 48% of firms not confident of being able to secure external finance from their existing banking partners.

Nearly half of owners reported having required external funding to help cash flow issues and/or working capital shortfalls in the past. Only 30% of those individuals secured that funding from a bank, whilst 55% found financial support through an alternative lender or other, non-traditional, sources.