Business Loans

Made Simple

Fast business loans for UK limited businesses.

£5,000 – £75,000 funded within 24 hours

Check If Your Business Qualifies

Checking your eligibility won’t affect your credit score.

Capify helped us secure £35,000 to scale our stock levels before summer demand. It was quick, simple, and transformative.

Retail sector, North West UK

- Fast & Easy Application

- Dedicated Account Manager

- Flexible Amounts & Terms

Funding designed for small businesses

We are experts in setting up fast funding solutions for UK limited companies. As long as you meet the initial basic criteria, trading over 12 months and a turnover of over £120k per year, then we can help you access from £5000-£75000 with our straightforward service.

Let Us Get You Funded Fast

Simple Application Process

Online or on the phone, you can have your application completed with no fuss or complicated forms.

Flexible repayment terms

Terms and amounts to suit virtually any UK limited company that has over 12 months trading history

Unsecured Lending

Depending on your business turnover you can access up to £75,000 unsecured.

We keep our process simple

Apply online in a few minutes, receive a fast decision, and access funds in as little as 24 hours. There are no long forms or long processing times. Our business loans are designed for UK limited companies that need funding quickly, with a process that is easy to follow from start to finish.

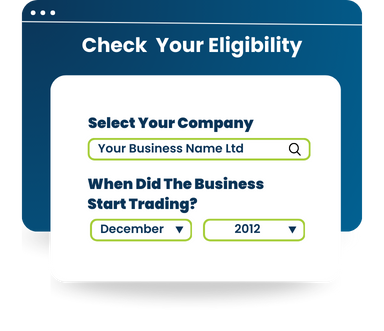

Eligiblity Check in 2 minutes

With a few simple details we can quickly tell you online if you are likely to be eligible for funding

Get approved within 24 hours

Complete the appplication and agree the best terms for your business. Funds could be in your account same day.

Repay early for free

If you circumstances change you can clear the loan with no hidden fees. You may eligible for futher funding for your business.

How much can I borrow?

Small business funding typically ranges from: £5,000 – £75,000. Your business performance determines your exact offer. Use the Business Loan Calculator below to estimate how much you can borrow.

Business Loan Calculator

Get an estimate of how much you might be able to borrow

3 months

£ 10,000

Your estimate will appear here

Move the sliders to get your instant loan estimate

You may be eligible for a loan amount up to:

£0

* Subject to Capify's standard credit assessment criterial terms & conditions

Your Repayment:

Daily repayments:

£0

Monthly repayments:

£0

Total Cost of Loan:

£0

Total Repayment:

£0

Check Your Eligibility

This calculator is for illustrative purposes only and is based on an example factor rate of 1.26. The factor rate offered to your business may vary based on your circumstances and loan terms. Processing and origination fees may apply. Repayments are collected by Direct Debit, meaning payments are taken on business days only.

We're here to help you grow

What Can You Use a Small Business Loan For?

Buying Equipment & Machinery

Purchase the tools, machinery, vehicles, or technology your business needs to operate or grow. A loan can help you spread the cost while keeping cash available for day-to-day expenses.

Cashflow

Cover everyday running costs, unexpected expenses or annual expenses, such as VAT or corporation tax bills, while waiting for invoices to be paid. This helps keep your business running smoothly without unnecessary stress.

Purchase Stock and Inventory

Get access to fast funding to ensure you have the stock and inventory to service existing clients or for unexpected big orders.

Frequently asked questions

Who can apply for small business funding?

We accept applications from any UK Ltd that has been trading for more than 12 months and with over £10k per month turnover. We have options for all credit profiles. Complete our eligibility checker today and one of our team will get in touch to help find the perfect solution.

How quickly can I find out if I’m eligible?

You can check you eligibility in less than 60 seconds by clicking here. As long as your business is Ltd, with over £10k monthly turnover and trading for 12 months we shoudl be able to help.

How fast can I receive the funds?

Our process is fast and straightforward. In many case we can have loans approved and funded in 24 hours.

Can I apply if my credit history isn’t perfect?

Of Course! As long as your company has been trading for over 12 months as an LTd and turns over £120k per year or more, then, regardless of credit profile we should be able to find you a solution for your needs.

Can I repay early?

Yes, there are no extra charges for early repayment.

Check Your Eligibility

In 2 Minutes

No impact on your credit score.

No lengthy forms.

Decision in hours.

Check Funding Options

Capify is a trademark licensed to United Kapital Limited (company registration number 06575165), Capify Uk Limited (Company Number 10183728) registered in England and Wales with offices Hamilton House, 249 Church Street, Altrincham, WA14 4DR.